Services Provided

- Budgeting/Cash Flow Planning

- Protection Planning

- Life Insurance

- Annuities (Fixed & Indexed)

- Disability Income Insurance

- Long-Term Care Insurance

- Homeowner's Insurance

- Auto Insurance

- Umbrella Insurance

- Renter's Insurance

- Investment Planning

- Stocks

- Bonds

- Mutual Funds

- ETFs

- Separately Managed Accounts

- Annuities (Variable)

- Life Insurance (Variable)

- Income Tax Planning

- Pay Stub Analysis

- Roth Conversion Analysis

- We do NOT prepare tax returns

- Retirement Income Planning

- IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Solo 401(k)

- 401(k)/403(b)/457

- Estate Planning

- Account titling

- Trust planning (we do NOT create trusts)

- Education Planning

|

How I am Paid1

I may be paid in one or more of the following ways:

- Fee-based advice

- I may be paid for my time to provide financial or investment advice or to create and deliver a financial plan

- Fee-based assets under management (AUM)

- I may be paid a percentage of your account value to manage one or multiple investment accounts

- Commission

- I may be paid on insurance sales

- I may be paid on commissionable investment products such as variable life insurance, variable annuity products, or some mutual funds

- I may be paid for transactions within a brokerage account (non-advisory/AUM account)

|

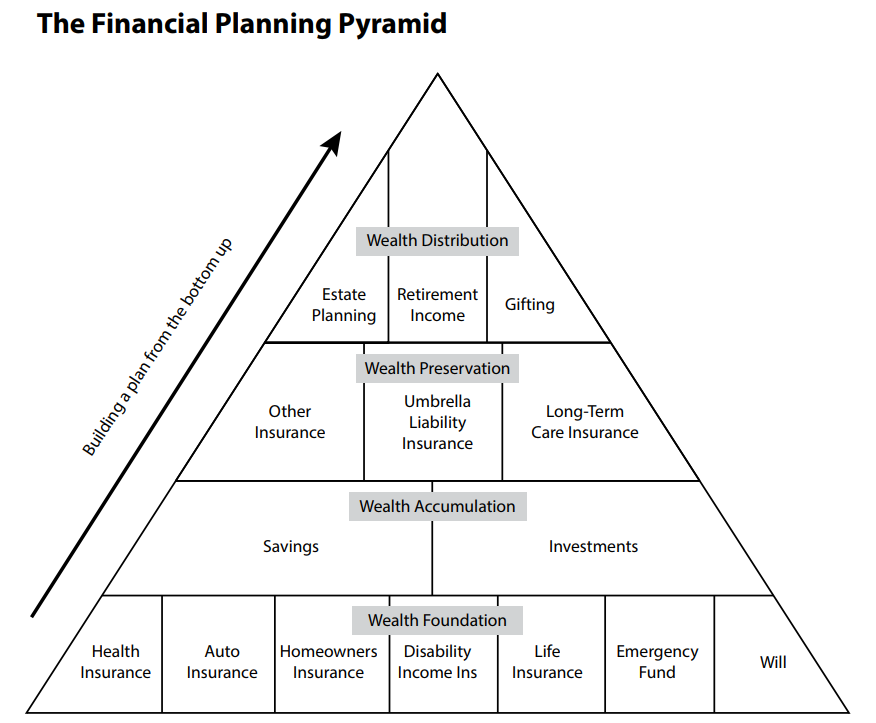

Source: The American College of Financial Services

Neither MML Investors Services nor any of its employees or agents are authorized to give legal or tax advice. Consult your own personal attorney legal or tax counsel for advice on specific legal and tax matters. Estate planning services are provided working in conjunction with your estate planning attorney, tax attorney, or CPA. Consult them for specific advice on legal and tax matters.

Auto & homeowner's insurance are offered by unaffiliated insurers.

1For more details on how I am paid, ask to view MML Investors Services' Form CRS & Reg BI Disclosure Form.